Best Budgeting Template for Free in 2025

Introduction

Managing finances effectively is more important than ever in 2025. Whether you’re tracking personal expenses or managing business finances, having a budgeting template can help you stay on top of your financial goals. With a free expense tracker, you can monitor income, expenses, and savings without the need for expensive financial software.

This guide explores the best free budgeting template available in 2025, how to use it effectively, and why it’s essential for financial success.

Why You Need a Budgeting Template in 2025

Get Your FREE Expense Tracker Template Now!

Simplify your finances and gain full control over your budget – Download instantly!

✅ Over 10,000 downloads and counting!

💼 Perfect for personal and business use.

🔐 We respect your privacy.

A budgeting template provides a structured way to:

- Track income and expenses efficiently.

- Set savings goals and stick to them.

- Monitor cash flow and avoid overspending.

- Analyze financial trends with automated calculations.

- Improve decision-making with clear financial insights.

Instead of relying on manual calculations, an expense tracker automates the process, ensuring accuracy and saving time.

Features of the Best Free Budgeting Template in 2025

The best free budgeting template in 2025 includes:

- Pre-built categories for expenses (housing, groceries, transportation, entertainment, etc.).

- Automated calculations for total income, expenses, and remaining balance.

- Expense tracking dashboard with real-time financial insights.

- Customizable sections to match personal or business needs.

- Interactive charts and graphs to visualize spending habits.

- Savings and investment tracking to plan for the future.

- Debt repayment tracker to monitor and reduce outstanding loans.

How to Download the Free Budgeting Template

The best free budgeting template for 2025 is available for download from various sources, including:

- Microsoft Excel Templates Library (official free templates).

- Google Sheets Template Gallery.

- Financial blogs and budgeting websites.

Once downloaded, open the file in Microsoft Excel or Google Sheets and save a copy for personal use.

How to Use the Expense Tracker for Effective Budgeting

Step 1: Set Up Your Budget Template

- Open the downloaded template and review the default settings.

- Customize the income sources and expense categories.

- Define monthly or weekly budget limits based on financial goals.

- Enter starting balances to track financial progress accurately.

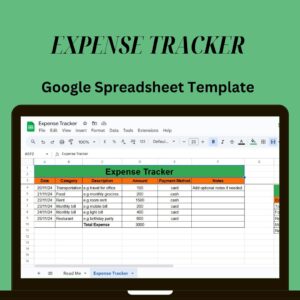

Step 2: Record Income and Expenses

Use the table format to track transactions:

Date | Description | Category | Income | Expense | Balance |

Record all income sources (salary, freelance work, rental income, investments, etc.).

- Log all expenses (rent, groceries, entertainment, etc.) under appropriate categories.

- The balance column will automatically update based on income and expenses.

Step 3: Automate Budget Calculations

Total Monthly Income

=SUM(D2:D100)

This formula calculates the total income for the month.

Total Monthly Expenses

=SUM(E2:E100)

This formula sums up all expenses, giving you a clear view of spending.

Remaining Balance

=D101-E101

This formula helps track how much money is left after expenses.

Step 4: Visualize Budget Performance with Charts

- Insert a pie chart to analyze spending by category.

- Use bar charts to compare income vs. expenses.

- Create a line graph to track budget trends over multiple months.

Step 5: Set Financial Goals and Monitor Progress

- Savings Goals – Define a monthly savings target and track contributions.

- Debt Reduction Plan – Monitor outstanding loans and credit card balances.

- Investment Growth – Track portfolio performance for better investment decisions.

Step 6: Automate Alerts for Overspending

Use Conditional Formatting in Excel to highlight overspending:

- Select the Expense Column.

- Click Home → Conditional Formatting → New Rule.

- Apply red formatting if an expense exceeds a defined limit.

This feature ensures that you stay within budget and avoid unnecessary costs.

Step 7: Share and Update the Budget Template Regularly

- Save the file in Google Drive or OneDrive for easy access.

- Set weekly or monthly reminders to update financial records.

- Use password protection to secure sensitive financial data.

Advanced Budgeting Strategies for 2025

To make the most out of your budgeting template, consider these advanced strategies:

- Zero-Based Budgeting – Assign every dollar a specific purpose to maximize efficiency.

- Envelope System – Use separate budget categories for different spending areas.

- Expense Forecasting – Predict future expenses based on past trends to avoid surprises.

- Integration with Financial Apps – Export Excel data into apps like Mint or QuickBooks for deeper analysis.

Common Budgeting Mistakes and How to Avoid Them

Even with a great expense tracker, mistakes can happen. Here are some common pitfalls to avoid:

- Not updating the budget regularly – Set reminders to enter transactions daily or weekly.

- Ignoring small expenses – Small purchases add up and impact your budget.

- Not adjusting budget limits – Modify spending categories based on real-life needs.

- Overcomplicating the process – Stick to simple templates that are easy to use.

- Failing to track irregular expenses – Include annual fees, holiday spending, and unexpected costs.

Conclusion

Using a free budgeting template is one of the best ways to manage finances in 2025. Whether you need a personal finance tracker or a business expense manager, an Excel template provides the flexibility and automation required for success.

- Gain better control over spending habits.

- Optimize savings and investments.

- Stay on track with financial goals.

- Reduce financial stress and plan for the future.

Start budgeting today by downloading the best free Excel expense tracker template and take charge of your finances!

Get Your FREE Expense Tracker Template Now!

Simplify your finances and gain full control over your budget – Download instantly!

✅ Over 10,000 downloads and counting!

💼 Perfect for personal and business use.

🔐 We respect your privacy.