How to Track Daily Expenses Without Apps: A Simple and Effective Guide

Introduction

Managing daily expenses is crucial for financial stability, but not everyone wants to rely on mobile apps or complex software. Fortunately, you can track your spending effectively using simple manual methods, spreadsheets, and traditional budgeting techniques.

In this guide, you’ll learn how to track your daily expenses without using apps, helping you stay on top of your budget and reach your financial goals.

Why Track Your Expenses?

Get Your FREE Expense Tracker Template Now!

Simplify your finances and gain full control over your budget – Download instantly!

✅ Over 10,000 downloads and counting!

💼 Perfect for personal and business use.

🔐 We respect your privacy.

Before diving into the methods, let’s look at why expense tracking is important:

✔ Prevents overspending – Helps you avoid impulse purchases.

✔ Identifies spending patterns – Shows where your money goes each month.

✔ Helps you save more – Allocates more money toward savings and investments.

✔ Reduces financial stress – Gives you more control over your budget.

Now, let’s explore the best ways to track expenses without an app.

Use a Notebook and Pen

One of the simplest and most effective ways to track expenses is by writing them down in a notebook.

How to Do It:

✔ Carry a small notebook with you or keep one at home.

✔ Each time you make a purchase, write down the date, amount, and category (e.g., groceries, transport).

✔ At the end of the day, total your expenses and review your spending habits.

💡 Pro Tip: Use different colored pens for different spending categories to make tracking easier.

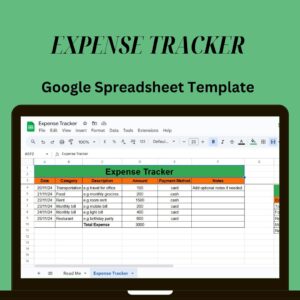

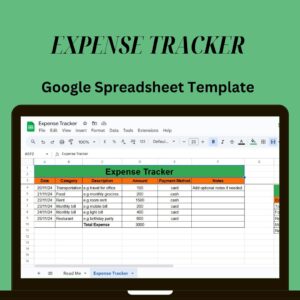

Create an Expense Tracker in Excel

If you prefer a more organized approach, Excel is a powerful tool for tracking expenses without an app.

How to Set Up an Expense Tracker in Excel:

1️⃣ Create a table with these columns:

Date (When you spent the money)

Category (Groceries, Rent, Transport, etc.)

Amount (Total spent)

Payment Method (Cash, Credit, Debit)

2️⃣ Use Formulas to Automate Totals:

SUM Formula to calculate total expenses:

excel

Copy

Edit

=SUM(C2:C100) # Adds up all expenses in column C

SUMIF Formula to track spending by category:

excel

Copy

Edit

=SUMIF(B:B, “Groceries”, C:C) # Sums all “Groceries” expenses

3️⃣ Add Conditional Formatting:

Highlight overspending in red when your expenses exceed a set budget.

📊 Bonus: Use Excel charts to visualize your spending habits over time.

Use a Whiteboard or Sticky Notes

For a visual approach, a whiteboard or sticky notes can be a great way to track expenses daily.

How to Do It:

✔ Set up a whiteboard in a visible area (kitchen, office, etc.).

✔ Divide it into sections: Daily Expenses, Total Spent, and Remaining Budget.

✔ Write down each expense at the end of the day.

✔ Erase and reset the board every week or month.

💡 Pro Tip: Use different colors for necessities vs. non-essentials to quickly spot overspending.

Keep Receipts and Review Them Weekly

Receipts are a great way to track expenses without writing them down immediately.

How to Do It:

✔ Keep all receipts from purchases in a dedicated folder or envelope.

✔ At the end of each week, review and categorize spending in a notebook or Excel sheet.

✔ Discard receipts once you’ve recorded them to keep things clutter-free.

💡 Pro Tip: Use separate envelopes for different expense categories (groceries, dining, bills) for easy sorting.

Use the Cash Envelope System

The cash envelope system is an excellent way to control spending without apps.

How to Do It:

✔ Withdraw cash at the beginning of the month.

✔ Divide it into envelopes labeled with different categories (e.g., Food, Transport, Entertainment).

✔ Use only the cash in each envelope for its designated purpose.

✔ Once the envelope is empty, stop spending in that category.

💡 Pro Tip: If there’s money left in an envelope at the end of the month, put it into savings!

Set a Daily Spending Limit with a Paper Tracker

If you struggle with impulse spending, setting a daily limit helps you stay disciplined.

How to Do It:

✔ Write down your maximum daily spending amount (e.g., $30).

✔ Track expenses daily in a simple chart to ensure you don’t exceed the limit.

✔ Adjust your budget if you overspend one day by cutting costs the next day.

💡 Pro Tip: Keep a running total so you always know how much is left to spend.

Review and Adjust Your Budget Weekly

Tracking expenses is only useful if you review and adjust your budget regularly.

How to Do It:

✔ Pick a day each week to go over your expenses.

✔ Compare your actual spending vs. budgeted amounts.

✔ Identify areas where you can cut back.

💡 Pro Tip: Write down three takeaways from each review session to improve spending habits.

Save Spare Change for Extra Savings

If you use cash often, saving spare change can help you accumulate unexpected savings.

How to Do It:

✔ Set up a jar or piggy bank for spare change.

✔ Empty your pockets daily and deposit coins.

✔ At the end of the month, count and deposit the total into a savings account.

💡 Pro Tip: Treat spare change as “bonus savings” and avoid spending it unnecessarily.

Final Thoughts

Tracking daily expenses without apps is simple, effective, and budget-friendly. Whether you choose a notebook, Excel, a whiteboard, or a cash envelope system, the key is to stay consistent.

📌 Which method will you try first? Let us know in the comments!

Get Your FREE Expense Tracker Template Now!

Simplify your finances and gain full control over your budget – Download instantly!

✅ Over 10,000 downloads and counting!

💼 Perfect for personal and business use.

🔐 We respect your privacy.

-

Sale!

Expense Tracker Advanced

Rated 0 out of 5$8.99Original price was: $8.99.$4.99Current price is: $4.99. -

360° Mastery SuperPack

Rated 0 out of 5$19.99 -

Personal Productivity PowerPack

Rated 0 out of 5$9.99