How to Fix Budgeting Mistakes Using Excel

Introduction

Budgeting is a crucial skill for managing personal and business finances, but mistakes can easily happen. Whether it’s underestimating expenses, forgetting irregular costs, or failing to track spending properly, these errors can derail your financial goals. Fortunately, Excel provides powerful tools to help you fix budgeting mistakes and take control of your finances.

In this guide, we’ll explore common budgeting mistakes and show you how to use Excel’s expense tracker, formulas, and automation tools to correct them efficiently.

Common Budgeting Mistakes and How to Fix Them in Excel

- Not Tracking Every Expense

The Mistake:

Many people fail to record small daily expenses, like coffee runs or impulse purchases. Over time, these small amounts add up and distort the budget.

-

Sale!

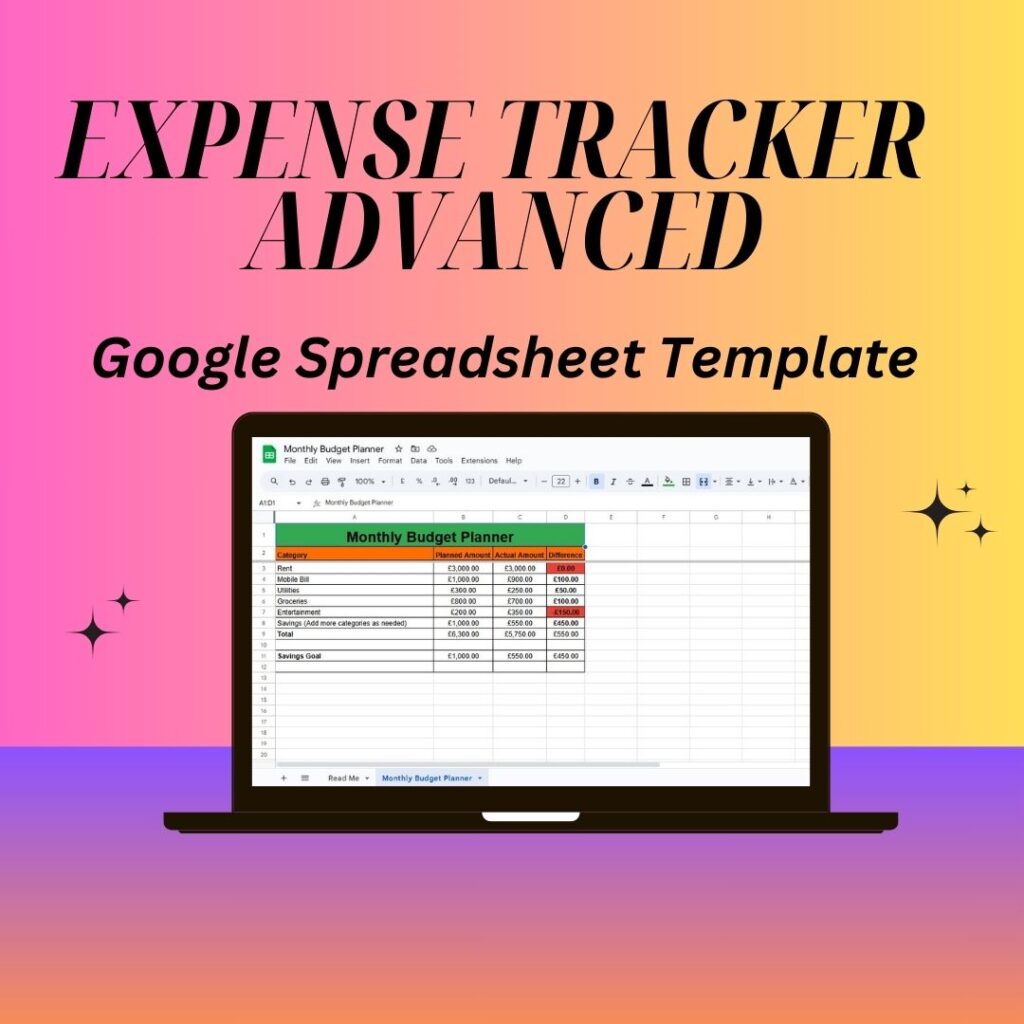

Expense Tracker Advanced

Rated 0 out of 5$8.99Original price was: $8.99.$4.99Current price is: $4.99. -

Sales Pipeline Tracker

Rated 0 out of 5$1.99 -

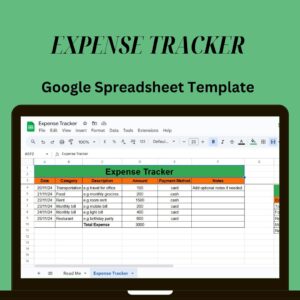

Expense Tracker

Rated 0 out of 5$1.99

How to Fix It in Excel:

✔ Use an expense tracker spreadsheet to log all transactions.

✔ Create a table with columns for Date, Category, Description, and Amount.

✔ Use the SUM function to calculate total expenses automatically.

📌 Example Formula:

excel

Copy

Edit

=SUM(B2:B50) # Adds up all expenses in column B

💡 Pro Tip: Use Data Validation to create a dropdown list for easy expense categorization.

- Setting an Unrealistic Budget

The Mistake:

Underestimating expenses or overestimating income can lead to constant budget failures.

How to Fix It in Excel:

✔ Analyze past spending with Excel’s AVERAGE function to create a realistic budget.

✔ Compare past and projected expenses using a trend analysis chart.

📌 Example Formula to Find the Average Expense per Month:

excel

Copy

Edit

=AVERAGE(B2:B12) # Calculates the average spending in column B

✔ Adjust your budget based on real spending habits instead of assumptions.

- Forgetting Irregular Expenses

The Mistake:

Many budgets ignore non-monthly expenses like insurance, car repairs, or holiday shopping, causing unexpected financial strain.

How to Fix It in Excel:

✔ Create a separate sheet in your Excel file for yearly expenses.

✔ Use SUM and division formulas to spread these costs across months.

📌 Example Formula:

excel

Copy

Edit

=SUM(B2:B10)/12 # Distributes annual expenses over 12 months

✔ Include these amounts in your monthly budget to avoid surprises.

- Not Categorizing Expenses Properly

The Mistake:

Without properly categorized expenses, it’s hard to see where your money is going.

How to Fix It in Excel:

✔ Use Pivot Tables to group expenses into categories automatically.

✔ Apply Conditional Formatting to highlight overspending.

📌 Steps to Create a Pivot Table:

Select your expense data.

Go to Insert > Pivot Table and place it in a new worksheet.

💡 Pro Tip: Use color coding to see which categories exceed the budget.

- Not Automating Budget Calculations

The Mistake:

Manually tracking and calculating income, expenses, and savings is time-consuming and prone to errors.

How to Fix It in Excel:

✔ Automate budget calculations using formulas like SUM, IF, and VLOOKUP.

✔ Set up alerts when spending exceeds budgeted amounts.

📌 Example IF Formula for Overspending Alert:

excel

Copy

Edit

=IF(B2>C2, “Over Budget”, “Within Budget”) # Compares expenses (B2) to budget (C2)

✔ If the result shows “Over Budget,” adjust your spending immediately.

- Not Allocating Money for Savings

The Mistake:

A budget without a dedicated savings plan means you won’t reach financial goals.

How to Fix It in Excel:

✔ Set up a savings tracker in Excel with a goal amount and progress tracking.

✔ Use Goal Seek to calculate how much you need to save each month.

📌 Example Formula to Track Savings Progress:

excel

Copy

Edit

=(B2/B3)*100 # Calculates percentage of savings goal reached

✔ Automatically allocate a percentage of your income to savings using formulas.

- Ignoring Budget Reviews and Adjustments

The Mistake:

A budget that isn’t reviewed or updated quickly becomes ineffective.

How to Fix It in Excel:

✔ Create an Excel Dashboard with graphs showing financial trends.

✔ Use Data Analysis tools to compare spending month by month.

📌 How to Create a Budget Chart in Excel:

Select your expense data.

Go to Insert > Chart and choose a Bar or Pie Chart.

Label your categories for a clear financial overview.

💡 Pro Tip: Set a calendar reminder to review your budget weekly.

Step-by-Step Guide to Fixing Your Budget in Excel

✅ Step 1: Download a Free Expense Tracker Excel Template

Choose a template with automated calculations and expense categories.

✅ Step 2: Input Your Income and Expenses

Use Excel formulas to total income and expenses automatically.

✅ Step 3: Identify and Fix Budgeting Mistakes

Use Pivot Tables to categorize spending.

Set up Conditional Formatting to highlight overspending.

✅ Step 4: Adjust Your Budget and Allocate for Savings

Use SUMIF formulas to track spending per category.

✅ Step 5: Automate Budget Updates with Excel Formulas

Use IF statements, VLOOKUP, and SUMIF for easy tracking.

✅ Step 6: Review Your Budget Weekly and Make Adjustments

Use Excel charts and trend analysis tools to stay on track.

Final Thoughts

Fixing budgeting mistakes in Excel is simple and effective when you use the right formulas, expense trackers, and automation tools.

By following these steps, you can regain control of your budget, prevent overspending, and achieve your financial goals.

📥 Download your free Excel expense tracker today and start budgeting smarter!

Get Your FREE Expense Tracker Template Now!

Simplify your finances and gain full control over your budget – Download instantly!

✅ Over 10,000 downloads and counting!

💼 Perfect for personal and business use.

🔐 We respect your privacy.